DOGE Price Prediction: Analyzing the Bullish and Bearish Factors for 2025

#DOGE

- DOGE shows oversold technical signals but remains below key moving averages

- Whale accumulation patterns conflict with recent price weakness

- The $0.20 level represents a critical psychological and technical support zone

DOGE Price Prediction

DOGE Technical Analysis: Key Indicators to Watch

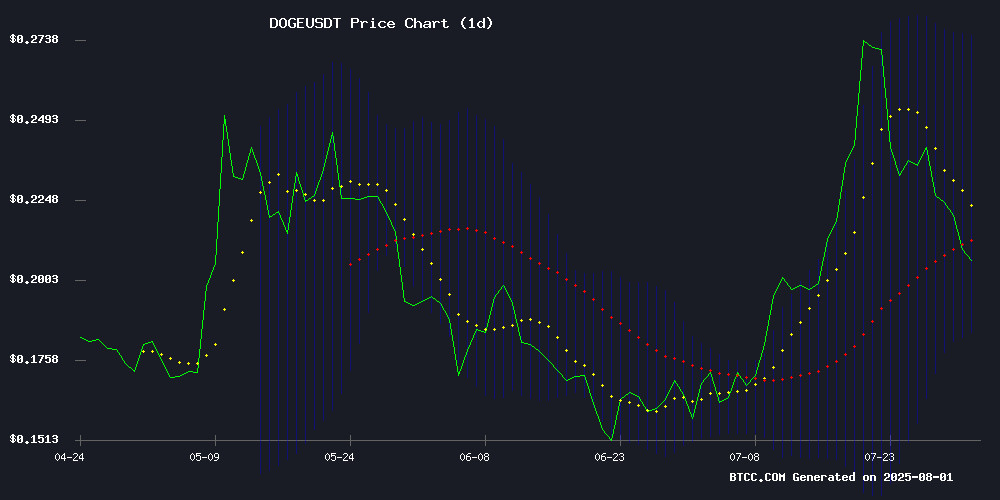

According to BTCC financial analyst Emma, DOGE is currently trading at $0.20569, below its 20-day moving average of $0.229545, indicating potential short-term bearish pressure. The MACD histogram shows a slight bullish crossover at 0.011759, suggesting some buying momentum. However, with the price NEAR the lower Bollinger Band ($0.18402), DOGE may be oversold in the near term. 'The convergence of these indicators suggests DOGE could see a technical rebound if it holds above $0.20,' Emma notes.

Market Sentiment: Whale Activity Hints at DOGE Accumulation

BTCC's Emma observes mixed signals from recent headlines: 'While the 8% price drop reflects short-term weakness, the formation of a monthly bullish engulfing candle and whale accumulation patterns suggest institutional interest at current levels.' She adds, 'The dichotomy between technical oversold conditions and fundamental accumulation makes $0.20-$0.21 a critical decision zone for DOGE's next major move.'

Factors Influencing DOGE's Price

Dogecoin Price Poised for Next Move as Monthly Bullish Engulfing Candle Forms

Dogecoin is signaling a potential bullish reversal despite recent bearish pressure, with its price hovering around $0.2062 after a 1% drop in the past 24 hours. The meme cryptocurrency has seen five consecutive red candles this week, but on-chain indicators and technical charts suggest the retracement may be setting the stage for a powerful upward move.

Whales appear to be accumulating DOGE near the $0.20-$0.21 support level, with wallets adding approximately 130 million tokens in late July. Balanced funding rates across exchanges indicate market neutrality, reducing liquidation risks and creating stable conditions for a potential breakout.

A monthly bullish engulfing candle is forming on Dogecoin's chart - a classic reversal pattern that historically precedes significant trend changes. Resistance looms between $0.25-$0.27, but a sustained break above $0.26 could propel DOGE toward $0.30 and beyond. Some technical projections suggest even more ambitious targets may come into play if bullish momentum accelerates.

Dogecoin Accumulation by Whales Signals Potential Rally Ahead

Dogecoin's recent price pullback to $0.21 has triggered aggressive accumulation by whale investors, with 130 million DOGE tokens purchased in 24 hours. This buying spree during a 13.6% weekly decline suggests strong conviction in an imminent rebound.

Exchange data reveals a notable shift in holder behavior, with net outflows indicating movement to cold storage rather than exchange wallets. Such patterns have historically preceded local market bottoms, creating a bullish technical setup.

The derivatives market adds fuel to the potential rally, with $4 billion in open interest and neutral funding rates reducing liquidation risks. Technical analysts project a 35% upside to $0.30, while historical models suggest eventual targets between $1.42-$2.11 could be in play.

Dogecoin Investment Outlook and Purchasing Guide in 2025

Dogecoin, the pioneering meme-coin launched in 2013, continues to captivate investors with its volatile price action and celebrity endorsements. Trading near $0.22 in mid-2025, DOGE exhibits modest recovery but faces skepticism due to its unlimited supply cap and lack of utility beyond social sentiment.

Analysts project divergent paths: Changelly forecasts a dip to $0.238 by July 2025, while CoinCodex anticipates a 49% surge to $0.3229. The coin remains tethered to Elon Musk's influence and community hype—a double-edged sword that amplifies both rallies and sell-offs.

For buyers, centralized exchanges like Coinbase, Binance, and Kraken offer fiat on-ramps via cards or bank transfers. Yet seasoned traders caution that DOGE's speculative nature demands strict risk management given its 5 billion annual issuance rate and absence of smart contract functionality.

DOGE Suffers 8% Drop Amid Institutional Accumulation at Key Support Level

Dogecoin (DOGE) faced a sharp 8% decline, dropping from $0.22 to $0.21 between July 31 and August 1, marking one of its steepest daily losses this month. The cryptocurrency oscillated within a $0.03 range, encountering stiff resistance at $0.23 while finding temporary footing at $0.21. Trading volumes surged to 1.25 billion DOGE during the final hours of the session, far exceeding the 24-hour average of 365 million, signaling heightened liquidation activity.

Despite the sell-off, institutional interest emerged as a counterbalance. Wallets linked to institutional players accumulated 310 million DOGE during the downturn, with Bit Origin adding 40 million tokens to its treasury as part of a broader $500 million diversification strategy. The broader crypto market remains under pressure, weighed down by macroeconomic uncertainty and ambiguous inflation trajectories.

Is DOGE a good investment?

Emma from BTCC presents a balanced view: 'DOGE shows both opportunities and risks at current levels. The technical setup suggests possible upside, but investors should consider these key factors:'

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.20569 | 11.5% below 20MA |

| Bollinger Bands | $0.18402-$0.27507 | Near lower band (oversold) |

| MACD | 0.011759 | Bullish crossover emerging |

'While whale accumulation is bullish, DOGE remains a high-risk asset. Dollar-cost averaging near $0.20 with proper position sizing could be prudent,' Emma concludes.